Fica calculation 2023

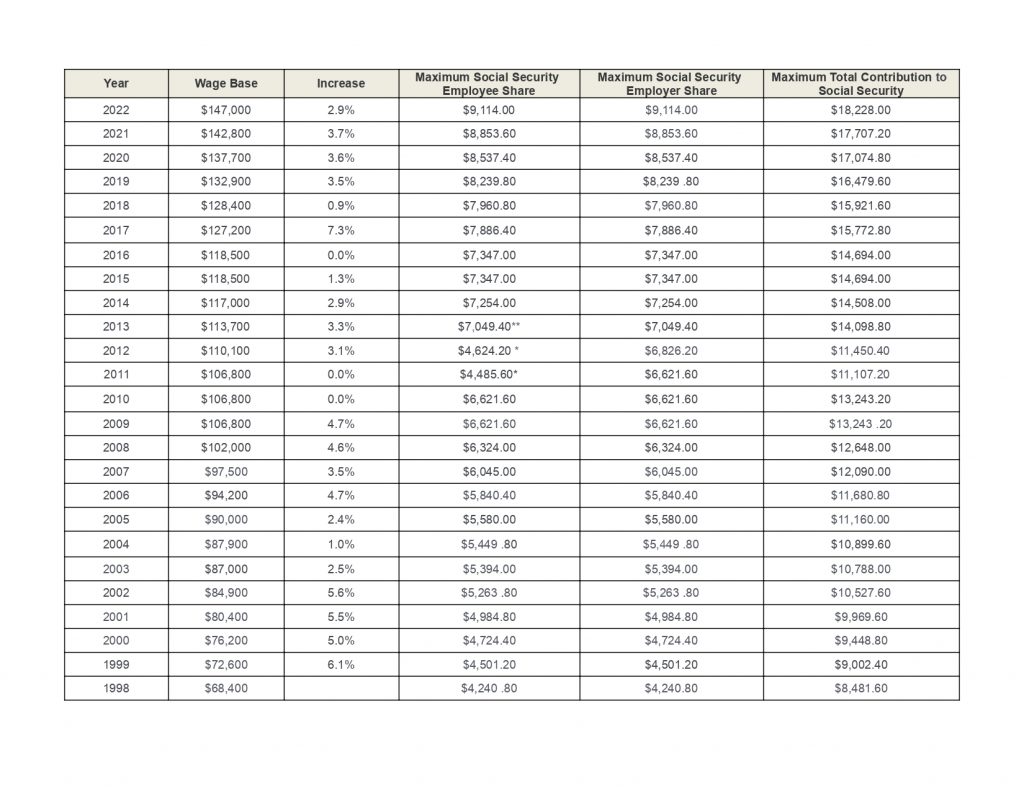

For 2011 and 2012 the OASDI tax rate is reduced by 2 percentage points for employees and for self-employed workers resulting in a 42 percent effective tax rate for employees and a 104. The current tax rate for social security is 62 for the employer and 62 for the employee or 124 total.

Proposed Law Impact On Social Security Taxable Wage Base Isdaner Company

Social security deductions are a flat amount for both the employee and the employer.

. Social Security and Medicare Withholding Rates. Normally these taxes are withheld by your employer. This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available.

The SSA provides three forecasts for the wage base. Use the calculator below to view an estimate of your deduction. Over a decade of business plan writing experience spanning over 400 industries.

Ad Being an Industry Leader is Earned. Enter your gross wages for the pay period. Since the rates are the same for employers and.

This Tax Calculator will be updated during 2022 and 2023 as new 2023 IRS Tax return data becomes available. Employer will deduct social security contribution would be. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

2022 Self-Employed Tax Calculator for 2023. A 09 Medicare tax may apply. According to the annual report for 2023 the wage base will be 155100 up from 147000 in 2022 and 142800 in 2021.

Start the TAXstimator Then select your IRS Tax Return Filing Status. Ad Being an Industry Leader is Earned Not Given Business Planning Simplified. As of July 2022 the trend toward a 2023 COLA is.

Beginning in 2023 the taxable. FICA mandates that three separate taxes be withheld from an employees gross earnings. Furtherdeduction for Medicare contribution would be.

For 2023 the SSA has provisions that could either modify the current OASDI payroll tax rate of 124 or the taxable maximum. Social security taxes 823980 this is calculated by. To calculate your employees FICA tax multiply the employees gross pay by the Social Security tax rate 62 and the Medicare rate 145.

FICA tax includes a 62 Social Security tax and 145 Medicare tax on earnings. 90000 x 62 5580. The 2022 Tax Calculator uses the 2022 Federal Tax Tables and 2022 Federal Tax Tables you can view the latest tax tables and historical tax tables used in our tax and salary calculators here.

Our free online FICA Tax Calculator is a super easy tool that makes it easy to calculate FICA tax for both those who are an employee and those who are self employed. For 2023 the trustees estimate that the taxable wage base will be 155100 up 8100 from the current wage base of 147000. In 2023 these deductions are capped at the annual maximum of 39943.

However if you are. This projection is based on current laws and. The current rate for.

Heres how you would calculate FICA taxes for this employee. CNBC reported that a recent congressional. 292219 268421 268421 x 100 88659 adjusted to the nearest 110 of 1 percent 89 Advertisement.

The amount that you should withhold from the employee. There are 3 things to keep in mind when applying FICA to your payroll. In 2022 only the first 147000 of earnings are subject to the Social Security tax.

Prepare and e-File your. 62 Social Security tax withheld from the first 142800 an employee makes in. 90000 x 145 1305.

The tax year 2022 adjustments described below generally apply to tax returns filed in 2023. Use this calculator to estimate your self-employment taxes. The tax items for tax year 2022 of greatest interest to most taxpayers include the.

Calculator And Estimator For 2023 Returns W 4 During 2022

2022 Wage Cap Jumps To 147 000 For Social Security Payroll Taxes

The Inflation Reduction Act Won T Affect Most Americans Tax Bill

Social Security Ending In 2023 No But What Really Happens When The Trust Fund Is Emptied

What Is The Bonus Tax Rate For 2022 Hourly Inc

How To Pay Payroll Taxes A Step By Step Guide

Social Security Benefits Could Be Permanently Depleted By 2023 If Payroll Taxes End

How To Calculate Fica For 2022 Workest

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

2022 2023 Self Employment Tax Calculator

2022 2023 Online Payroll Tax Deduction Calculator For 401 K 403 B Plan Withholdings

When Setting A New Employee Up For Direct Deposit Will I Have To Write A Manual Check For The First Payroll Processing

Employee Tax And Benefit Budget For A Retail Company Example Uses

Social Security Wage Base 2021 And Updated For 2022 Uzio Inc

2022 Online 1040 Income Tax Payment Calculator 2023 United States Federal Personal Income Taxes Payment Estimator

2 Social Security Changes That Could Benefit You In 2023 And 1 That Might Cost You The Motley Fool

Social Security What Is The Wage Base For 2023 Gobankingrates